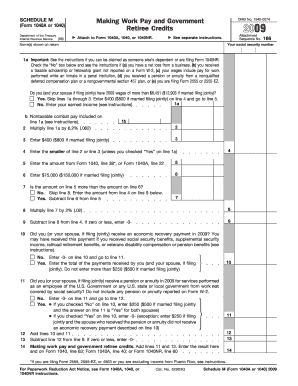

FORMS TO GO WITH 1040A CODE

government agency in charge of managing the Federal Tax Code Go to source X Trustworthy Source Internal Revenue Service U.S. This is often, but not always, the status with the highest standard deduction amount. If more than one status could apply to you, choose the one that gives you the lowest tax liability.

You owe additional tax on a qualified plan, such as an IRA.Even if your income is below these thresholds, you are required to file taxes if any of the following apply: X Trustworthy Source Internal Revenue Service U.S.

These vary depending on your filing status and are subject to change annually. Check the instructions in chart A, generally on page 7 of the instructions for Form 1040A for the current income thresholds. Basically, if your income is low enough, you are not required to file income taxes. Determine if you are required to file income taxes.

0 kommentar(er)

0 kommentar(er)